Here's how the 2290 tax form affects your annual vehicle expenses and tax filing obligations

Here's how the 2290 tax form affects your annual vehicle expenses and tax filing obligations

Blog Article

HHO car conversions are almost becoming a trend in some parts of America. Texas, Florida and California account for over 200,000 HHO enthusiasts. The most frequently converted cars are Ford, Toyota and GMC. Across the globe there are over 2 million families with an HHO hybrid.

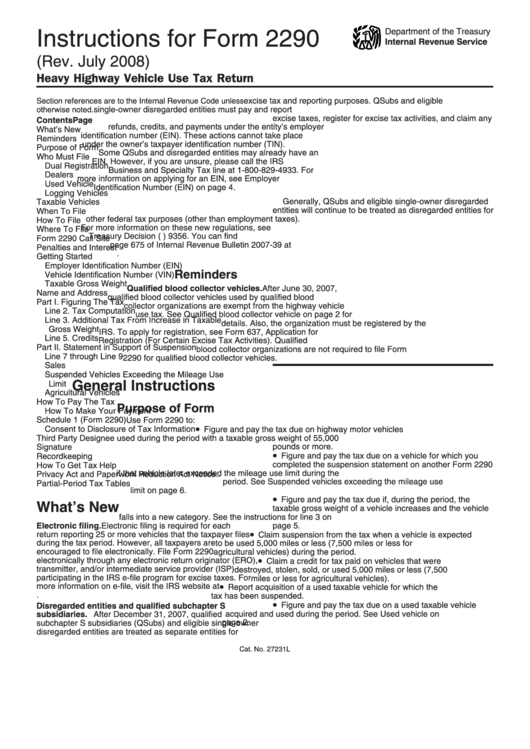

The 2290 tax form filing season officially kicks off in January but submitting returns too early can cause them to be incomplete. For example, if you performed contract work this year then your clients may issue a 1099 for payments made to you. If the statements do not arrive before you file it can cause underreporting of income and owing taxes. The best option is to confirm that the income on your books match the 1099's reported to the IRS. While waiting for tax statements to arrive, stay ahead of the game with good record-keeping. Although income tax forms and tax preparation software will be available at year-end, you must wait for the official opening of tax season to submit the return. You can check the date by visiting the Internal Revenue Service's website.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

As you generate leads over time you can sell products to them. If you are a blogger adding an autoresponder to your pages will help you tremendously in growing and managing a subscriber list. Subscribers mean followers, and followers mean that they will at least look at anything you offer them!

Before you move to Mexico, or if you have already relocated to Mexico, you must check with the U.S. state from which you expatriated for their specific IRS heavy vehicle tax laws.

Direct expenses would include a dedicated business phone line, repairs or utilities that are for the dedicated form 2290 work area alone, etc. These are deducted at 100%. (i.e., the window in your studio was repaired).

Anytime you can itemize you can save more money on income taxes so speak to your NYS CPA or tax consultant in New York to find out how you can itemize.